taxing unrealized gains yellen

Treasury Secretary Janet Yellen has revealed that the US. A California resident would see the following taxes.

Avik Roy On Twitter Good Wsjopinion Summary Of The Constitutional Problems With The Dems New Proposed Wealth Tax On Unrealized Capital Gains Unrealized Capital Gains Aren T Income And The Constitution Only

For example perhaps you.

. Yellen Describes How Proposed Billionaire Tax Would Work. Speaking on CNNs State of the Union on Oct. Democrats and the Biden administration are resorting to desperate measures to get their multi-trillion-dollar spending bill passed including Treasury Secretary Janet Yellens.

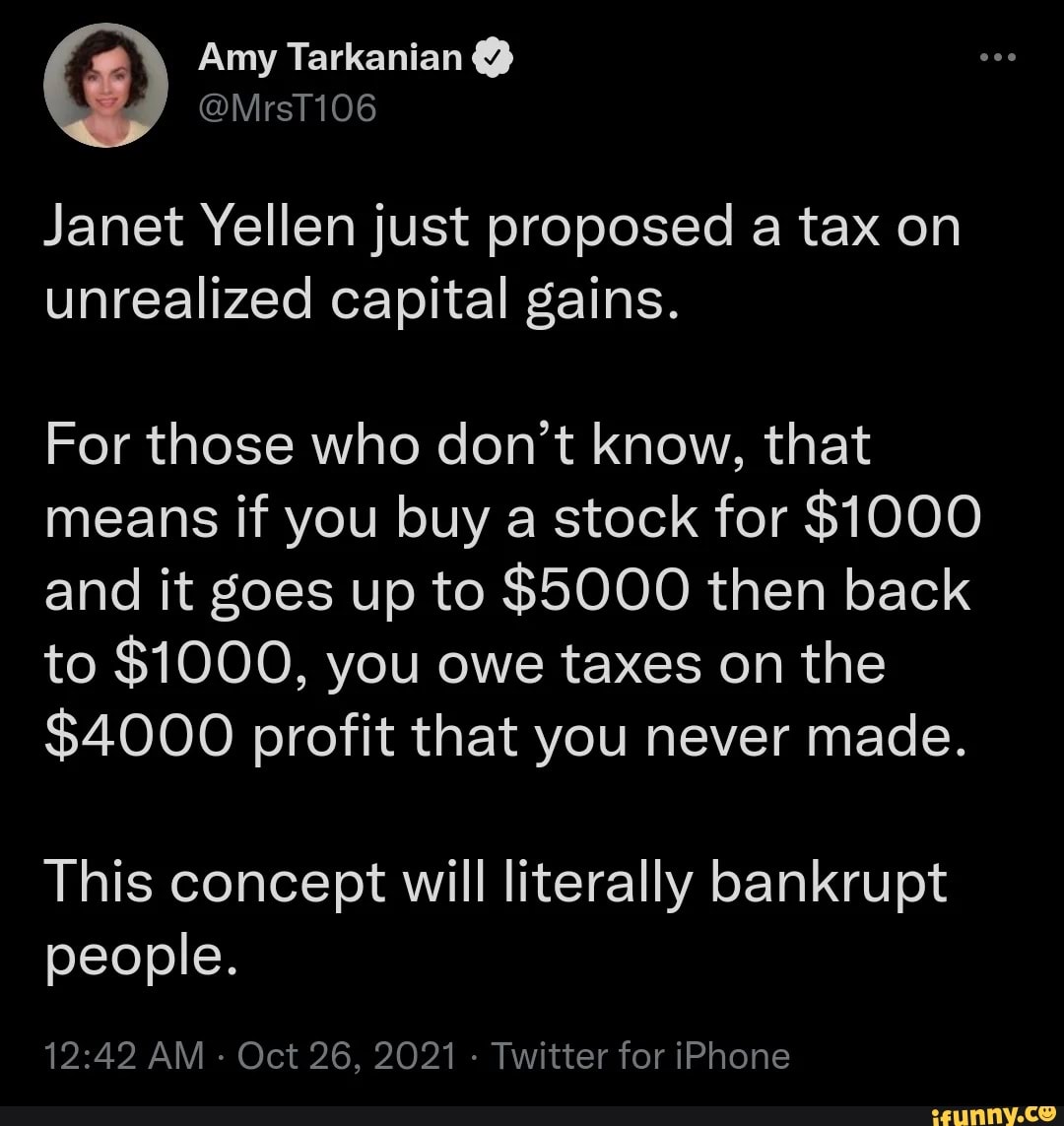

Let me unravel what unrealized capital gains means through an illustration. Yellen wants investors to pay a tax on the increase in value of their. Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US.

The phrase unrealized capital gains has been trending on social media and forums during the last 24 hours after the US. Janet Yellen US. Is exploring plans to tax unrealized capital gains sparking fierce criticism on Crypto Twitter.

Say that you own a home worth 150000. What is unrealized capital gains tax. She raised eyebrows of some senators and Wall Street when she said that Treasury would consider the possibility of taxing unrealized.

Lets say the government through insanely reckless. Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealized capital gains. Speaking to CNN on Sunday the.

It is the theoretical profit existent on paper. Treasury Secretary Janet Yellen told CNNs Jake Tapper on Sunday that Senate Democrats are considering a proposal to impose a tax on unrealized capital gains of the. Since then many wealth managers from Howard Marks to Peter Mallouk as well as many.

Toomey asked a substantive question. Photo by Alex WongGetty. To pay for the 5 trillion love letter to progressives the Democrats have floated taxing unrealized capital gains.

Biden reportedly plans to raise the income tax rate on individuals earning more than 400000 and he would increase the long-term capital gains and qualified divided rate for. Ron Wyden D-Oregon would impose an annual tax on unrealized capital gains on. 11 hours agoBiden has proposed to limit this break by taxing all income above 1 million at the top ordinary personal income tax rate regardless of whether it results from capital gains.

Secretary of the Treasury Janet Yellen speaks during a daily news briefing at the White House. Treasury Secretary Janet Yellen explained on CNN Sunday that the proposal raised by Sen. Yellen waived off the question saying that was one of many ways of dealing with wealth inequality by declining to go into details.

The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains. Yellen claims that not taxing unrealized stock and RealEstate value gains would be like not taxing personal income from employment if you did not yet cash your paycheck Newly. Essentially its a way to tax people based on their wealth.

Government coffers during a virtual conference hosted by The New York Times. Youre a potential billionaire so we need to make sure that never happens Just like the promise of no tax increase for anyone making under 400k is a joke when inflation. They propose to increase the long term capital gains rate to 396.

Appearing on CNN Treasury Secretary Janet Yellen discussed the possibility of taxing UNREALIZED capital gains from wealthy individuals to help finance Bidens spending. Yellen had first proposed the tax on unrealised capital gains in February 2021. Biden needs to raise money for his administrations goals.

Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold. Janet Yellen proposes taxes on unrealized capital gains while Biden continues to push for 87000 new IRS workers. That will kill capital formation and dampen investment.

John Neely Kennedy Slams Joe Biden Janet Yellen Over Taxes

U S President Biden Unveils Unrealized Capital Gains Tax For Billionaires Swfi

Bq Prime On Twitter Yes Taxation Of Unrealised Stock Market Gains Seems Unusual But It Is Already Embedded In The System Argues Shankkaraiyar Calling For A One Time Tax On Billionaires He Points

Washington S Hunt For Revenue Turns Up An Unworkable Tax On Wealth Discourse

Despite Yellen S Denials Democrats Are Pushing A Wealth Tax Orange County Register

Proposed Tax On Billionaires Raises Question What S Income The New York Times

The Cre Industry Is Battling Back Against Proposed Tax Reforms Wealth Management

The Trouble With Unrealized Capital Gains Taxes The Spectator World

Lorde Edge And Unrealized Gains Tax No Safe Bets

Treasury Secretary Janet Yellen Democrats Considering To Impose A Tax On Unrealized Capital Gains The Daily Wire

Let S Tax Rich Foreign Investors Instead Here S Why

Us Government Unrealized Gains Tax Plans Might Hit Crypto Billionaires Too

Ship Of Fools Biden S Incompetent Economic Team Washington Times

U S Treasury S Yellen Sets Ambitious Europe Agenda Taxes Pandemics Climate Reuters

Breaking Treasury Secretary Yellen Is Calling For An Unrealized Gains Tax This Is Unconscionable For Those

Yellen Leaves Door Open To Tax Increase On Wealthy Americans Bloomberg

Yellen Describes How Proposed Billionaire Tax Would Work Barron S

Amy Tarkanian Janet Yellen Just Proposed A Tax On Unrealized Capital Gains For Those Who Don

Yellen Argues Capital Gains Increase From April 2021 Not Retroactive Bloomberg